Last Updated on: 1st August 2023, 02:26 pm

Thinking about moving to Santa Barbara and even buying a home? If so, congratulations on this exciting new chapter in your life! Before you get started, you’ll need to know the ins and outs of property tax beforehand. Anything to do with property taxes can be confusing– and that’s not to mention that it works differently in every city.

To help you out, we’ve made this all-inclusive guide with everything you need to know about property taxes in Santa Barbara– the average property tax, due dates, how to pay or lower your tax bill, and much more!

Table of Contents

Santa Barbara Property Taxes

While the concept of property taxes were first established in England in the 14th century, the United States didn’t take on the taxing system until the 1700s. Thenceforth, each district, local government, and state in the U.S. determine the property tax rate for their home buyers.

Relatively high property taxes are present in Santa Barbara County– in fact, the city is ranked in the top half of all U.S. counties by property tax collections.

Prior to 1912, the state of California relied on property taxes for up to 70% of its revenue. Today, the state’s revenue includes 17% property tax. School districts, government workers, police and fire departments, and road construction are just a few of the many categories that heavily rely on Santa Barbara property taxes. This means the property tax is less severe than before however there’s more that Californians are levied upon– the highest being personal income tax.

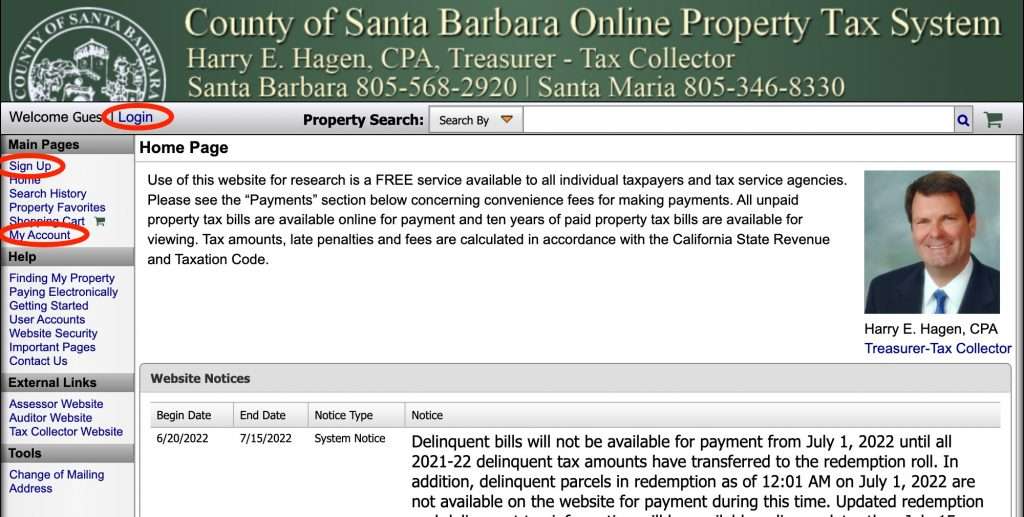

If you’re interested in more information regarding an overview of California property tax, visit the California State Board of Equalization. If interested, you can make an account or login with the Santa Barbara County Official website!

Curious how property taxes work in Santa Barbara? First off, it’s good to have a clear understanding on what property tax is. Property tax is an ad valorem tax that an owner has to pay based on the value of the property being taxed. The three steps to real property taxation in Santa Barbara are:

- Establishing tax rates

- Evaluating market value

- Bringing in the tax

Property taxes in Santa Barbara are collected by the Treasurer-Tax Collector (SBC-TTC).

On the other hand, the California State Legislature is responsible for enacting the tax laws. The duties and responsibilities of these tax laws are established by the Revenue and Taxation Code, Government Code, State Constitution, Probate Code, and county ordinances.

The functions of the tax office in Santa Barbara County are organized into the following divisions:

- Treasurer

- Tax Collector

- Public Guardian

- Public Administrator

- Deferred Compensation

- Veterans’ Services

Santa Barbara Assessor/Collector

The Assessor/Collector’s office in Santa Barbara, California, is under one office, and Joseph E. Holland is the person in charge. The Santa Barbara assessor has the duties of:

- Discovering, identifying, and assessing all property (real and personal) within Santa Barbara County in order to develop the secured and unsecured assessment rolls.

- Establishing and maintaining a set of 4,900 maps for the assessment of all real property in Santa Barbara County.

- Providing a public information service to answer taxpayers’ questions about property assessment and ownership.

The assessor of Santa Barbara does not:

- Set property tax rates.

- Compute property or mail out tax bills.

- Collect property taxes.

- Establish property tax laws.

Within Santa Barbara County, the taxable value– the cash or market value at time of transfer– of your property is determined by the County Assessor. In other words, the Santa Barbara property taxes get determined through the assessment value of your home. Until the property is resold or any new construction is completed, this value increases no more than 2% per year whereas the changes must be reassessed.

Keep in mind that assessed value is another way to say taxable value. Santa Barbara has an assessed value of 100%.

Santa Barbara Property Tax Assessor/Collector’s Office

- Email the assessor of Santa Barbara County

- Phone number: 805-568-2550

- Office hours: Monday through Friday; 8 pm-5 pm (excluding holidays)

- Office location : 105 E Anapamu St, Room 204, Santa Barbara, CA 93101

There are two more office locations of the Santa Barbara Assessor which can be found here on the Santa Barbara County official website.

Santa Barbara Treasurer/Tax Collector

Harry E Hagen CPA runs the tax collector’s office, and they are in charge of the finances for Santa Barbara County. They will receive, account, and apply the different funds to the required sectors.

The Santa Barbara Treasurer-Tax Collector (SBC-TTC) is responsible for:

- Receiving, safeguarding, and investing county, school, and special district funds

- Collecting taxes and revenues

- Administering estates for county residents when required as public administrator

- Administer conservatorships for county residents when required as public guardian

- Assisting county veterans in obtaining State and Federal Benefits

Santa Barbara Treasurer-Tax Collector’s Office

- Phone number: 805-568-2920

- Office hours: Monday through Friday; 8 pm-5 pm (excluding holidays)

- Office location: 105 E Anapamu St, Room 109, Santa Barbara, CA 93101

Santa Barbara Property Tax Rate

Santa Barbara County has a median property tax of $2,919.00 per year, based on a median home value of $576,500.00. The median effective property tax rate in Santa Barbara is 0.51% of property value. In Santa Barbara County, the property tax rate is $5.10 for every $1,000 of real estate value, or 0.51%.

The property tax in Santa Barbara is calculated by multiplying the assessed value of the property by the applicable tax rates. This is an estimate of what an owner would pay if they do not benefit from any exemptions. The Santa Barbara tax rate is A factor levied per $100 of assessed valuation and is used to determine the revenue of taxing agencies and districts within the specific tax rate area (TRA).

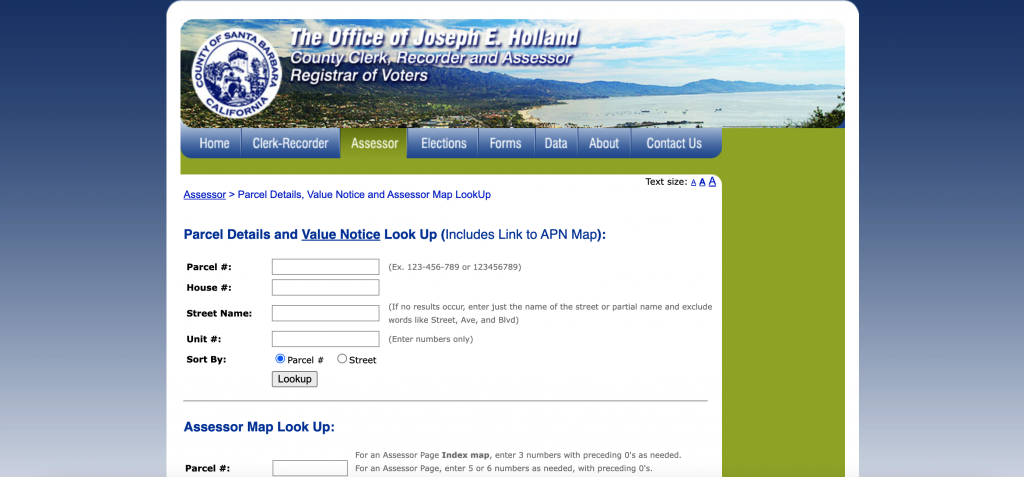

The Santa Barbara County Assessor-Collector’s office has a parcel map and property tax lookup tool you can used.

Important laws that limit property tax increases and assessments in Santa Barbara include Proposition 4, Proposition 13, Proposition 111, and Proposition 218.

Santa Barbara Property Tax

Based on the Parcel Details and Value Notice Look Up, we wanted to provide an example of the property information you can find. We entered an address within the Santa Barbara area and chose a single-family home. This home was expected to pay $5,603.92 for property taxes in 2021. Below is a breakdown of the different categories based on the tax rate per $100:

- City (Santa Barbara): $6.7037

- School: $2.2594

- Santa Barbara Unified Dist General: $22.2990

- Santa Barbara County General: $12.3247

- Education Revenue Augmentation: $7.9113

Based on this information and the property tax value of $560,391, we can figure out each category’s total amount of taxes.

- City (Santa Barbara): $670.37

- School: $225.94

- Santa Barbara Unified Dist General: $2,229.90

- Santa Barbara County General: $1,232.47

- Education Revenue Augmentation: $791.13

The city of Santa Barbara has a property tax rate of 0.51 per $100 of value. Everyone in the city of Santa Barbara has different total taxes due to their specific location.

Santa Barbara County Property Taxes by District

Between all the school district taxes, county and city tax rates, and special tax districts, there are hundreds of different tax rates in the county.

The Santa Barbara property tax rate for 2021/2022 is 0.51%. However, there are individual school district taxes and some areas are in a special tax district as well. This includes:

- Santa Barbara City College 2008-V: 0.00709

- Sta Ynez Val Water Cons Dist No 1: 0.05825

- Buellton Union School District 2004-U: 0.03000

- Lompoc Valley Medical Center Bond 2005: 0.06464

The school districts with the highest and lowest tax rates are:

- Highest: Lompoc Unified School District 2002-N: 0.02385

- Lowest: Montecito Union School District 1997-F: 0.00007

Santa Barbara Property Tax Payments – Due Dates & How to Pay Your Tax Bill

How to Make Santa Barbara Property Tax Payments

Curious when you’ll receive your annual secured property tax bills in Santa Barbara? Santa Barbara County property tax bills are mailed out to the owner of the property during the month of October every year. This means you can expect to receive your tax bill from October 1st to the 31st.

After you’ve received your tax bill, there are four different ways how to pay your property tax bills in Santa Barbara County.

- Online: You can pay your Santa Barbara property taxes online by visiting the Treasurer-Tax Collector’s Online Property Tax System website. Here, credit card and ACH (E-Check) payments can be made. It’s recommended to use E-Check because they are processed without any convenience fees.

- By Phone: An automated interactive voice response system allows you to make credit card and electronic check payments. Call Toll-Free at 877-399-8089 or Local at 805-724-3008 to make a Santa Barbara property tax payment by phone.

- By Mail: You can easily mail a check to Harry E Hagen, Treasurer-Tax Collector. However, make sure the mail is United States Postmarked by the delinquent date in order to avoid late penalties. If you’re paying your Santa Barbara property tax by mail, here is the address to send the tax payments to:

Harry E Hagen

Treasurer-Tax Collector

P.O. Box 579

Santa Barbara, CA 93102

- In-person: In-person Santa Barbara property tax payments are also an option. There are two County Treasurer-Tax Collector’s Office locations:

Santa Barbara

County Administration Building

105 E Anapamu Street

Room 109

Santa Barbara, CA 93101

Phone: 805-568-2920

Santa Maria

Betteravia Government Center

511 E Lakeside Parkway

Santa Maria, CA 93455

Phone: 805-346-8330

Both offices operate Monday-Friday, 8 am-5 pm, holidays excepted.

Santa Barbara Delinquent Property Tax Penalties

There are two waves of property tax payments to pay in Santa Barbara County: the first installment and the second installment. November 1st is the due date for the first installment of taxes whereas December 10th is considered late. Likewise, February 1st is the due date for the second installment and the payment is considered late after April 10th. If you intend on paying both installments at the same time, December 10th is the Santa Barbara property tax deadline.

Wondering what the consequences are of delinquent property taxes in Santa Barbara County? Well, if you fail to pay both the first and second installment, the property becomes tax-defaulted which results in additional costs and penalties. The same goes for supplemental property taxes.

A 10% delinquent penalty is added to any unpaid balance of the first installment. There is also a 10% penalty plus a charge of $30 for any unpaid balance of the second installment. However, if the Santa Barbara property tax due dates fall on a holiday or weekend, taxes are not considered late until the next business day at 5 pm.

If you’re a homeowner, veteran, impoverished, or disabled individual, you may qualify for Santa Barbara County property tax exemptions, programs, or payment plans.

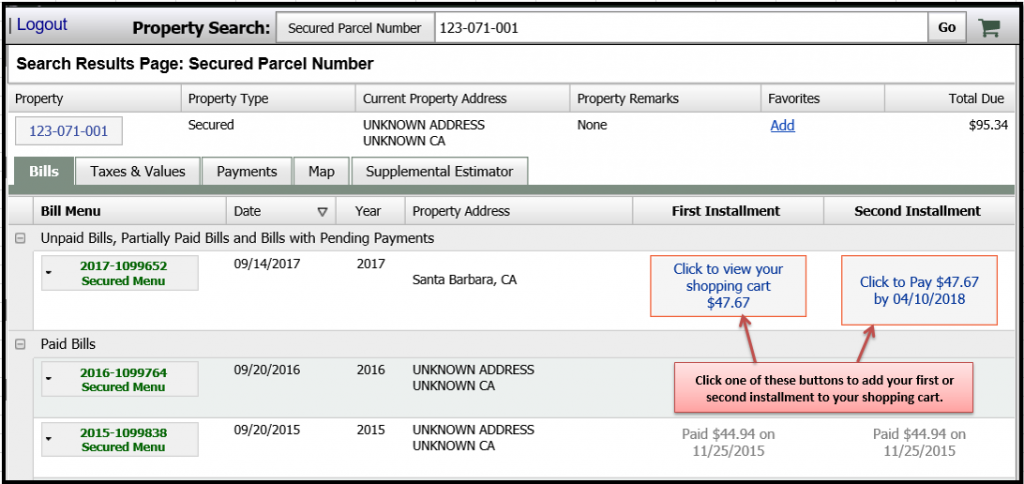

Santa Barbara Property Search/Tax Records

After entering your parcel number, house number, street name, or unit number into the Parcel Details and Value Notice Look Up tool, it will direct you to an APN property map– a free interactive search tool. This will inform you of the tax bill number, the amount of property taxes you owe, the parcel number if needed, payment history, and assessment history.

Another option is to use the “Assessor Parcel Information Lookup” which also works by entering your parcel #, house #, street name, or unit #. You can also go to the SBC-TTC and do a “Property Search”.

Property Records Database is another reliable way to search your property records.

Santa Barbara County Property Tax Exemptions

The Santa Barbara County Assessor/Collector will take care of the exemptions for your property tax. Keep in mind that one exemption may not be available in all locations– so check with your local government beforehand. Below are examples of a few different types of exceptions.

You can apply for a $7,000 exemption from your assessed value if you own and occupy your home as your main place of residence on January 1.

If a veteran is a resident of California as of the lien date, they are eligible for a Veteran’s Exemption of $4,000.

You may be eligible for a Santa Barbara property tax relief if a natural disaster such as a flood, earthquake, or fire damages or destroys your property.

You can click here to see a list of all additional property tax exemptions, programs, and payment plans in Santa Barbara County.

Santa Barbara Property Tax Appeals

If you disagree with your assessed value, you can either 1) contact the Assessor’s office and request to discuss your assessment or 2) file a formal Application for Changed Assessment with the Santa Barbara County Clerk of the Board.

Keep in mind that after you receive the supplemental value, you have 60 days to file applications for the review of supplemental assessments. These must be filed between July 2nd and November 30th.

Here is the location of The Clerk of the Board:

105 E Anapamu Street

Room 407

Santa Barbara, CA 93101

The phone number is 805-568-2240.

Santa Barbara County Property Tax FAQ

What are the Santa Barbara property tax due dates?

- First installment due: November 1st; late December 10th by 5 pm

- Second Installment due: February 1st; late April 10th by 5 pm

- Total amount due of both first and second installment (optional): December 10th by 5 pm

How can I pay my property taxes in Santa Barbara County?

You can pay your Santa Barbara property taxes in four different ways. The most common is through the online property tax system website. Here, you can make credit card and ACH (E-Check) payments.

Another option is to call the Toll-Free at 877-399-8089 or Local at 805-724-3008 and make credit card payments and electronic check payments.

If you’d rather send your payment through the mail, you can do so by sending it to Harry E Hagen, Treasurer-Tax Collector. Here is the address:

Harry E Hagen

Treasurer-Tax Collector

P.O. Box 579

Santa Barbara, CA 93102

Visiting one of the two Treasurer-Tax Collector Offices by 5 pm is another option to pay your property taxes.

Where can I look up my property taxes for Santa Barbara County?

Santa Barbara County has a search tool where you can view the assessment history from the last ten years of your property. Under “Property Search” you can view the property type, address, remarks, and the total amount you owe.

If you want to use a Santa Barbara County property search tool with an interactive map, you can do so via Parcel Details and Value Notice Look Up or Property Records Database by entering your parcel #, house #, street name, or unit #.

Now that you’re aware of the property tax information for Santa Barbara County, are you wanting to relocate to the area? When you’re ready to begin the moving process, Martian Movers is here to give you a smooth and stress-free move. With nearly a decade of experience, our dedicated team of experts are ready to transfer you to your new home! Call our Santa Barbara movers today at 805-779-3844.